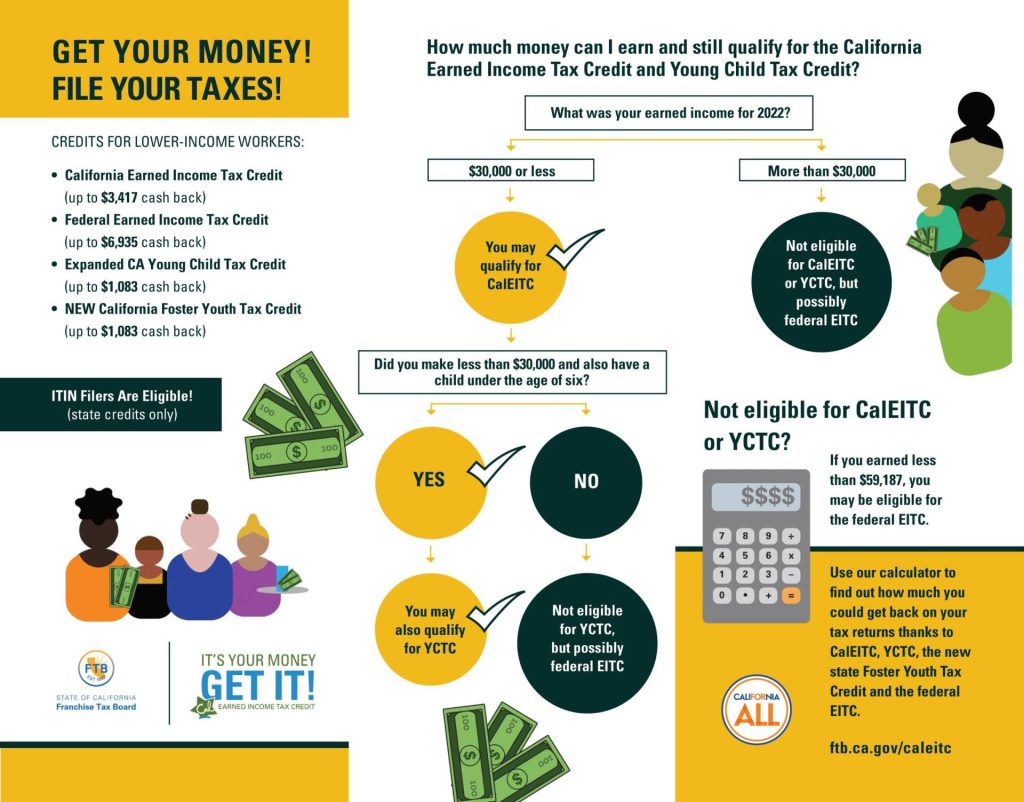

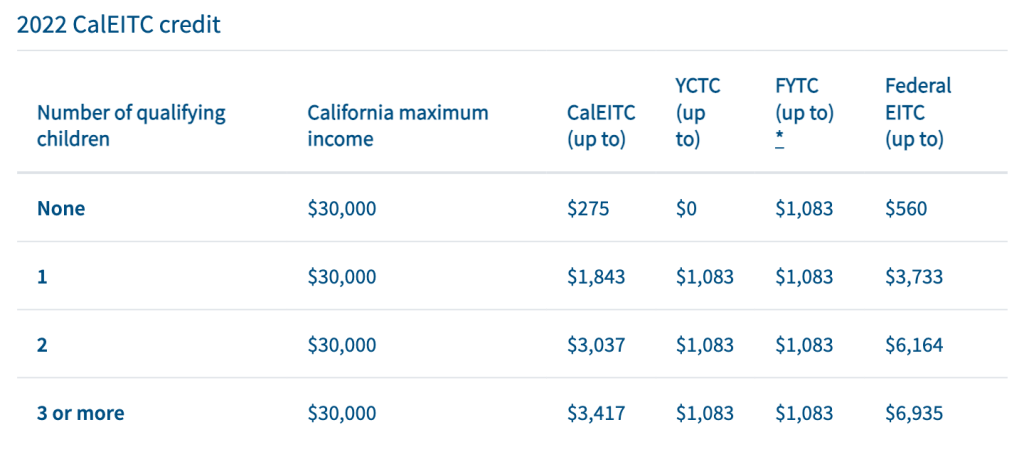

California Earned Income Tax Credit

The California Earned Income Tax Credit (CalEITC) is a state-level tax credit that helps low-income workers and families in California. It supplements the federal Earned Income Tax Credit (EITC) by providing financial support based on income and family size. CalEITC can either reduce your tax owed or provide a refund and it is administered by the California Franchise Tax Board. Eligible individuals can claim it when filing their state tax returns.

Eligibility Requirements

- You’re at least 18 years old or have a qualifying child

- Have a minimum earned income of $1.00 and a maximum of $30,000

- Possess a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.

- Reside in California for more than half of the filing year.

- Cannot be claimed as a qualifying child by another taxpayer.

- Cannot be claimed as a dependent by another taxpayer, unless you have a qualifying child.

Young Child Tax Credit

The Young Child Tax Credit (YCTC) provides up to $1,083 per eligible tax return for California families with a qualifying child under 6-years old at the end of the tax year. To qualify, families must have earned an income of $30,000 or less and meet CalEITC requirements– with one exception- beginning with tax year 2022, individuals may qualify for YCTC with a total earned income of zero dollars or less if the following conditions are met:

Note: Tax filers with an Individual Taxpayer Identification Number (ITIN) may now qualify for the California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC).